Contents:

On theCategorydropdown, selectOther deductions. Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business. It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more.

Midsize Businesses The tools and resources you need to manage your mid-sized business. Your Guide to Growing a Business The tools and resources you need to take your business to the next level. Your Guide to Running a Business The tools and resources you need to run your business successfully.

What is an Employee Cash Advance Account?

Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them. Outside of the actual process, remember that confidentiality is key in this delicate circumstance. While you might want to confirm that the advance is necessary, you shouldn’t inquire what the money is going toward. This not only builds rapport with your employee but eliminates any potential discrimination accusations in the future.

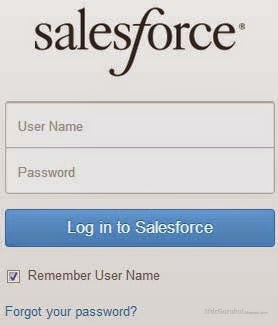

Type in the name and amount of the cash advance. Go to the employee’s profile and proceed to the Pay types section. There should be an option for Payroll Loan directly in the payroll module as there are in other programs I have used.

How to record an advance to an employee

Review your printing options for checks and direct deposits. You can enter hours using the grid, or you can choose Open Paycheck Detail to view a breakdown of everyone’s paycheck. To track your payroll, the Pay Period, and the Pay Date, select or review the QuickBooks Bank Account. Type None as the tax tracking type and Choose Next. But is this really the answer, Enterprise software saying to go use QuickBooks Online because it cannot handle roaming employees?

The tools and resources you need to run your business successfully. The tools and resources you need to get your new business idea off the ground. Paycheck Calculator Paycheck calculator for hourly and salary employees. Multimedia Hub Listen to the Mind the Business podcast by QuickBooks and iHeart. Self-Employed The tools and resources you need to run your own business with confidence.

The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is period costsd by a different analyst team. If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

- The transaction will not be included in the payroll reports if you will record it as a regular check.

- They are recorded on the income statement for the period in which they are incurred as these assets are used up.

- We provide you support through different channels (Email/Chat/Phone) for your issues, doubts, and queries.

- In case you are still having any issues related to this then you can connect with Dancing Numbers experts via LIVE CHAT any time as they are available round the clock.

- Relevant resources to help start, run, and grow your business.

Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files. Also, you can simplify and automate the process using Dancing Numbers which will help in saving time and increasing efficiency and productivity. Just fill in the data in the relevant fields and apply the appropriate features and it’s done. If you offer payroll advances to your employees, it’s important you establish payroll advance guidelines that must be followed by all employees without exception. These policy guidelines should then be incorporated into your payroll management processes and provided to your employees as part of an employee handbook.

© 2023 Intuit Inc. All rights reserved

A payroll advance is a short-term loan you give your employees, with the agreement that the loan will be repaid using future wages earned. Depending on the agreement you create with your employee, a payroll advance has specific terms that both you, the employer, and your employee will need to abide by. Keep in mind, business owners aren’t required to offer a payroll advance to their employees. If you’re already a QuickBooks user for other accounting processes, using a payroll add-on is by far the easiest way to start doing payroll.

Your approach works in terms of $$ in big picture, which is great, but the advance itself is not included in the Payroll module if you record it as a check. You can always visit ourEmployees and Payroll Taxesarticles in case you need some reference in handling your future payroll transactions. Feel free to read through theCreate, modify, and print checkslink for instructions and detailed steps. Relevant resources to help start, run, and grow your business. Paycheck calculator for hourly and salary employees. The tools and resources you need to take your business to the next level.

And I do apologize, the way I read your original post I “thought” you already had manual payroll turned on. You’ll want to make sure that the employee’s name exists in either your Vendor Center or in the Other Names List. One of our representatives will be happy to take a look at your account and help you get back on track ASAP. Enter the amount of the repayment, and then click OK.

To pay them, you can create an advance item. To get your money back, set up a deduction item on their paycheck. There is nothing in the employee handbook covering employee advances.

Repeat the same steps above to create a bank type clearing account if you don’t already have one listed in your chart of accounts. I created my own bank type account as a petty cash account. Thank you for choosing QuickBooks Online as your accounting and payroll partner. Let’s work together in creating and setting up employee advances and repayments. If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history.

Best Employee Scheduling Software – Forbes Advisor – Forbes

Best Employee Scheduling Software – Forbes Advisor.

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

Enter any relevant paycheck information, such as hours worked, money, memo, etc. Running your regular payroll can be made more effective by adopting pay schedules. Create a payroll schedule for your employees if you haven’t previously.

Choose the employee, then click to open the profile. I followed your directions and managed to set that up. Select the employee, then double click to open their profile.

Enter the total amount owed in the Annual Maximum field if you need to collect the advance payment over more than one paycheck. You must create an advance pay item if you choose to create a paycheck for the advance. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software. Everyone knows what a payroll advance is, but do you know the best way to handle them for your small business?

After a moment’s hesitation, Rachel agrees to a pay advance loan of $350. Rachel and Bob agree he will pay back the advance from his next four checks. Your employee should request a payroll advance in writing. QuickBooks is a great option for automated payroll. It’s straightforward, especially after the first time you input your payroll information, and the software is intuitive to use. Especially if your accounting department already uses QuickBooks for other purposes, it’s a seamless way to automate otherwise complex processes.

Gusto vs Paychex (2023 Comparison) – Forbes Advisor – Forbes

Gusto vs Paychex (2023 Comparison) – Forbes Advisor.

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

This is a different circumstance from the predominantly interest-free paycheck advance from the employer. Dancing Numbers is SaaS-based software that can easily be integrated with your QuickBooks account. You can import, export, and delete lists or transactions from your company file. Using Dancing Numbers you can simplify and automate the process, saving time and increasing productivity. Just fill in a few fields and apply the relevant features to complete the task.

- Go back to the employee’s profile and proceed to the Deductions and contributions section.

- Before you create a cheque for the advance, add a new current asset account to your chart of accounts to track advances.

- Enter any relevant paycheck information, such as hours worked, money, memo, etc.

Review our service offerings and apply for the service that best suits your nonprofit’s needs. Our team will review your application to determine whether we are a good fit for your organization’s needs. To record the expense transactions, we are going to do a zero-sum transaction using an expense form instead of a journal entry. Click the Deduction/contribution type drop-down arrow, and then select Other deductions.